Understanding the statement of cash flows can be a daunting task. In this video, we will discuss an intuitive way to think about the statement of cash flows that will make things much simpler.

Funnels and Flows

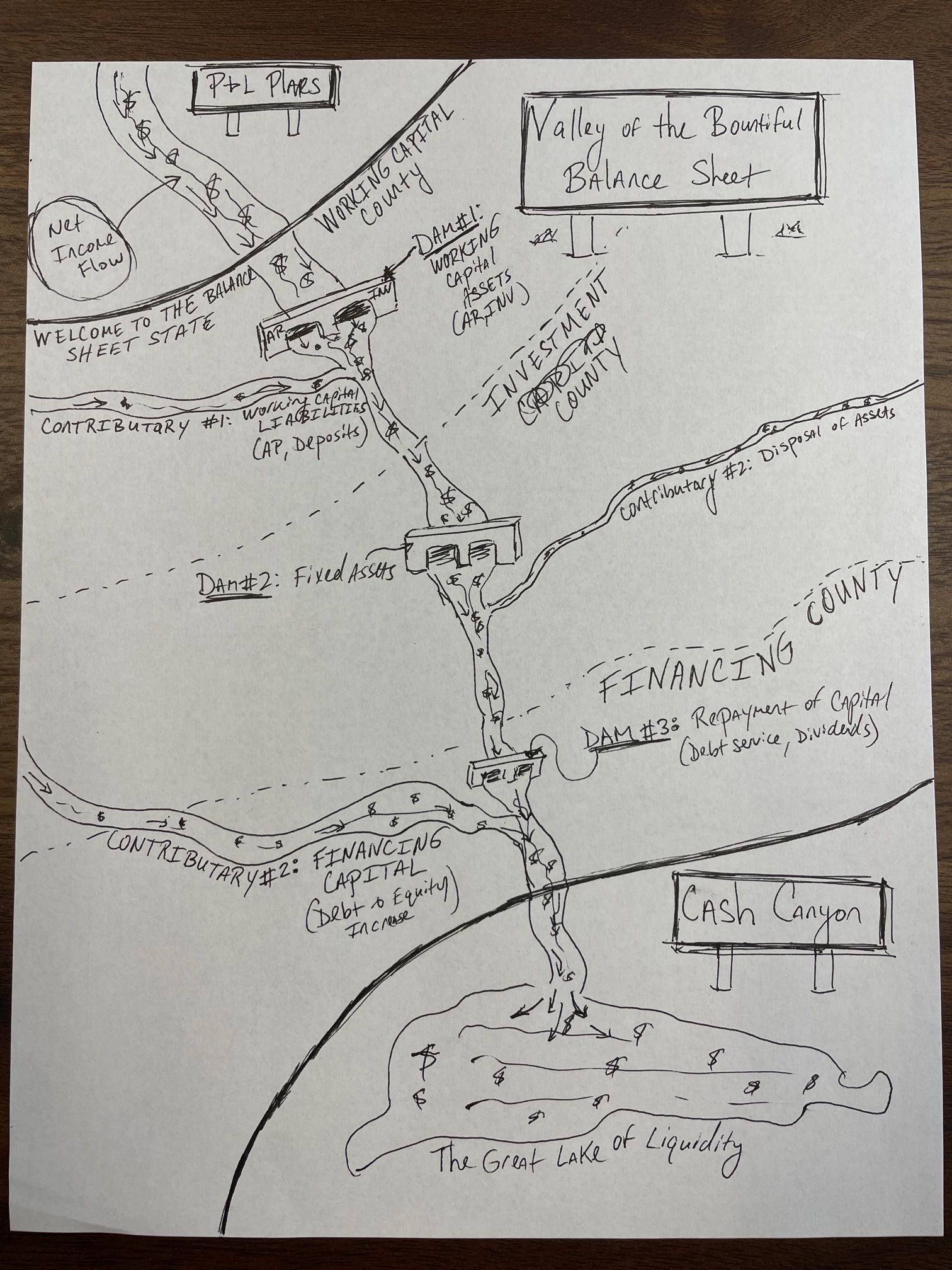

In a previous video, we discussed the Model of Funnels and Flows, or Funnels and Streams Method, to understand the Profit and Loss (P&L) Statement. This model consists of a sales funnel that is tweaked to turn leads into sales. The sales are then served by materials, commissions, and other costs, which turn into gross profit. This gross profit is then used to pay for overhead, and whatever is left over is the net income. This net income then flows into the balance sheet.

The Valley of the Bountiful Balance Sheet

The statement of cash flows helps measure the amount of money, or cash over a certain period of time (e.g. a month).

Tributaries and Dams

There are certain factors that add to cash and slow cash from moving through the system, or stop it completely. These factors are what we will call tributaries and dams. Tributaries are things that add to cash, and dams are things that slow or stop cash from moving through the system.

Working Capital County

The first dam is working capital assets. This is stuff like accounts receivable and inventory. When these go up, cash goes down, all things being equal. On the flip side, there are working capital liabilities like accounts payable and deposits. When a vendor gives you 30-day terms, this increases your working capital liabilities, which is a source of cash.

Investment County

The next county is Investment County. This is where you invest in buildings and equipment. This is also where you invest profits back into the business to continue to grow your cash flow.

Financing County

The third county is Financing County. This is where you take out loans, contribute cash to the business, and pay for investments and operations.

The Cycle

The cycle is an iterative one, where you generate cash flow through your activities, invest in new things using new financing, and improve cash flow. This is what we want to understand when we look at the statement of cash flows.

Conclusion

Understanding the statement of cash flows is essential to running a successful business. By understanding the tributaries and dams that contribute to cash flow, you can make sure that your business is running efficiently and sustainably.